FREE eBook: Learn How to Flip Houses and Escape the 9–5 Grind!

Get Your Free Ebook on Wholesaling Houses Today!

Unlock the Insider Secrets and Game-Changing Strategies That Top Real Estate Investors Use to Close There 1ST 10k Deal Starting Today!

10,000+

Success Stories

Building Wealth Through Real Estate Education

Our mission is to educate and inspire individuals to achieve financial freedom through strategic real estate investing, empowering them with the knowledge to make confident decisions.

Your Path to Mastering Real Estate Investing

Discover the essential tools to succeed.

Strategic Insights

Learn how to analyze markets effectively.

Smart Financing

Explore creative ways to fund investments.

Portfolio Growth

Master strategies to build your assets.

Risk Management

Mitigate risks for steady wealth growth.

Expert Guidance

Gain insights from seasoned professionals.

Blog

Explore a wealth of articles, expert tips, and resources designed to guide you on your real estate investing journey.

-

Make Money Flipping Homes: Escape the 9–5 and Take Control of Your Life

Are you tired of living paycheck to paycheck? Sick of answering to…

-

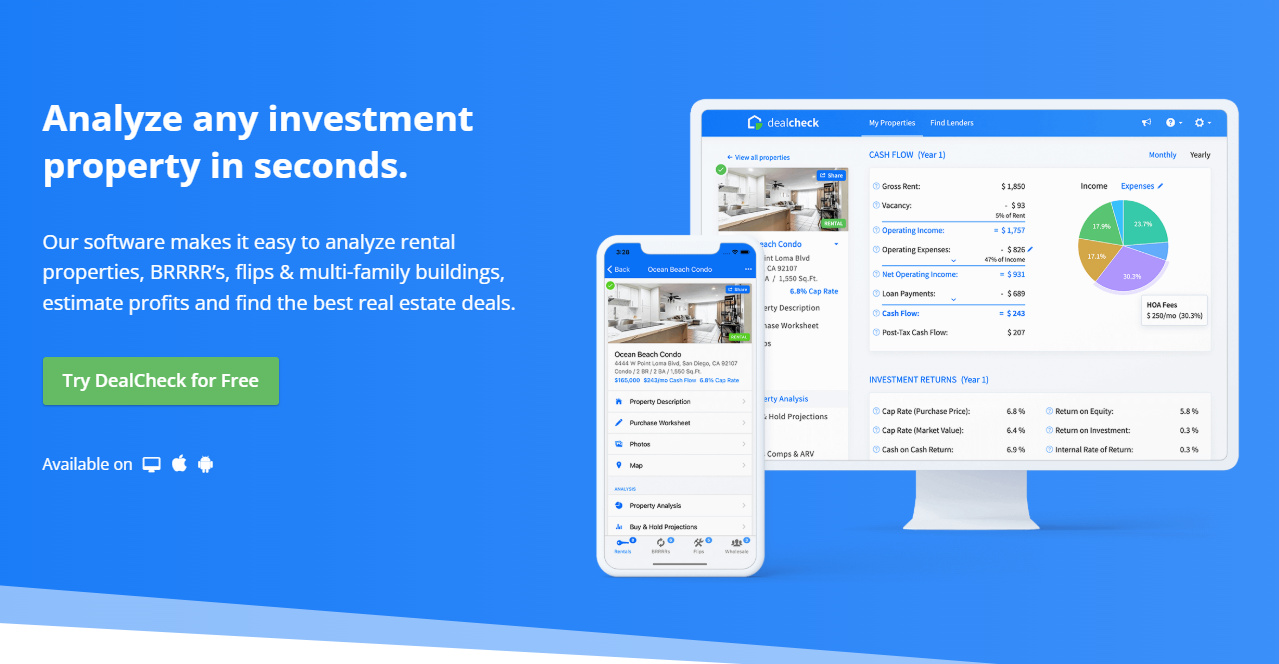

DealCheck Review: Real Estate Analysis Tool (2025 Breakdown)

Introduction to DealCheck DealCheck has emerged as one of the most popular…

-

Rehab Valuator Review: A Powerful Tool for Real Estate Investors (2025 Analysis)

Introduction: What is Rehab Valuator? Rehab Valuator is a specialized software platform…

Master the Basics of Real Estate Investing

Explore inspiring success stories from real clients who achieved their goals through our guidance.

Working with this team transformed my approach to real estate investing—highly recommend!

Sarah Johnson

Real Estate Investor

The team’s support and expertise made my first investment experience seamless and rewarding.

Michael Lee

Property Developer

Their professionalism and attention to detail were second to none, delivering outstanding results.

Emily Davis

Wealth Strategist

I couldn’t be happier with the knowledge and resources provided—it’s been a game-changer!

James Carter

Investment Consultant

Master Real Estate Investment Strategies

Join us today to unlock actionable insights and exclusive tools for real estate success.