Buying real estate can be a great way to make money. But before you buy, you need to know if the deal is good. Here are some simple ways to check a real estate deal.

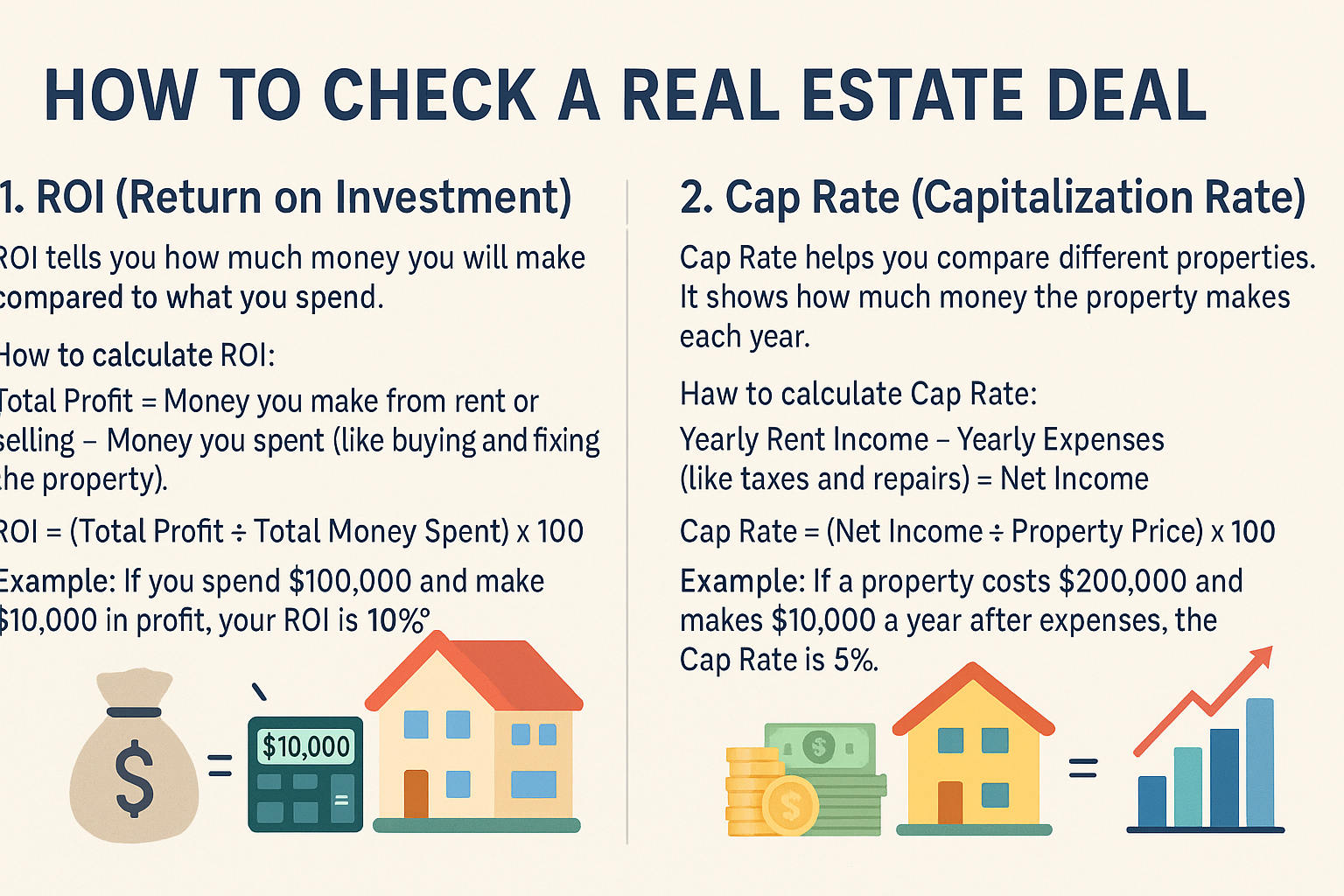

1. ROI (Return on Investment)

ROI tells you how much money you will make compared to what you spend.

How to calculate ROI:

Total Profit = Money you make from rent or selling – Money you spent (like buying and fixing the property).

ROI = (Total Profit ÷ Total Money Spent) x 100

Example:

If you spend $100,000 and make $10,000 in profit, your ROI is 10%.

2. Cap Rate (Capitalization Rate)

Cap Rate helps you compare different properties. It shows how much money the property makes each year.

How to calculate Cap Rate:

Yearly Rent Income – Yearly Expenses (like taxes and repairs) = Net Income

Cap Rate = (Net Income ÷ Property Price) x 100

Example:

If a property costs $200,000 and makes $10,000 a year after expenses, the Cap Rate is 5%.

3. Cash Flow

Cash flow is the money you have left after paying all bills.

How to calculate Cash Flow:

Monthly Rent – Monthly Expenses (loan, taxes, repairs, etc.) = Cash Flow

Example:

If rent is $1,500 and expenses are $1,200, your cash flow is $300 per month.

Why These Numbers Matter

Good ROI means you make more money.

Good Cap Rate means the property makes steady income.

Positive Cash Flow means you earn money every month.

Final Tip

Always check these numbers before buying a property. If you want to learn more about fixing houses to make more money, check out this helpful software: Rehabbing Houses for Profit.

Happy investing! 🏠💰

Leave a Reply