Wholesaling in Texas (2025): A Step-by-Step Guide for Your First Assignment

Wholesaling works in Texas, but it’s not “push a button, print a check.” It’s a real business with real rules. Follow this playbook, respect the process, and you can get a clean first assignment on the board in 30–60 days.

Download your free TX checklist .

What wholesaling is (in plain English)

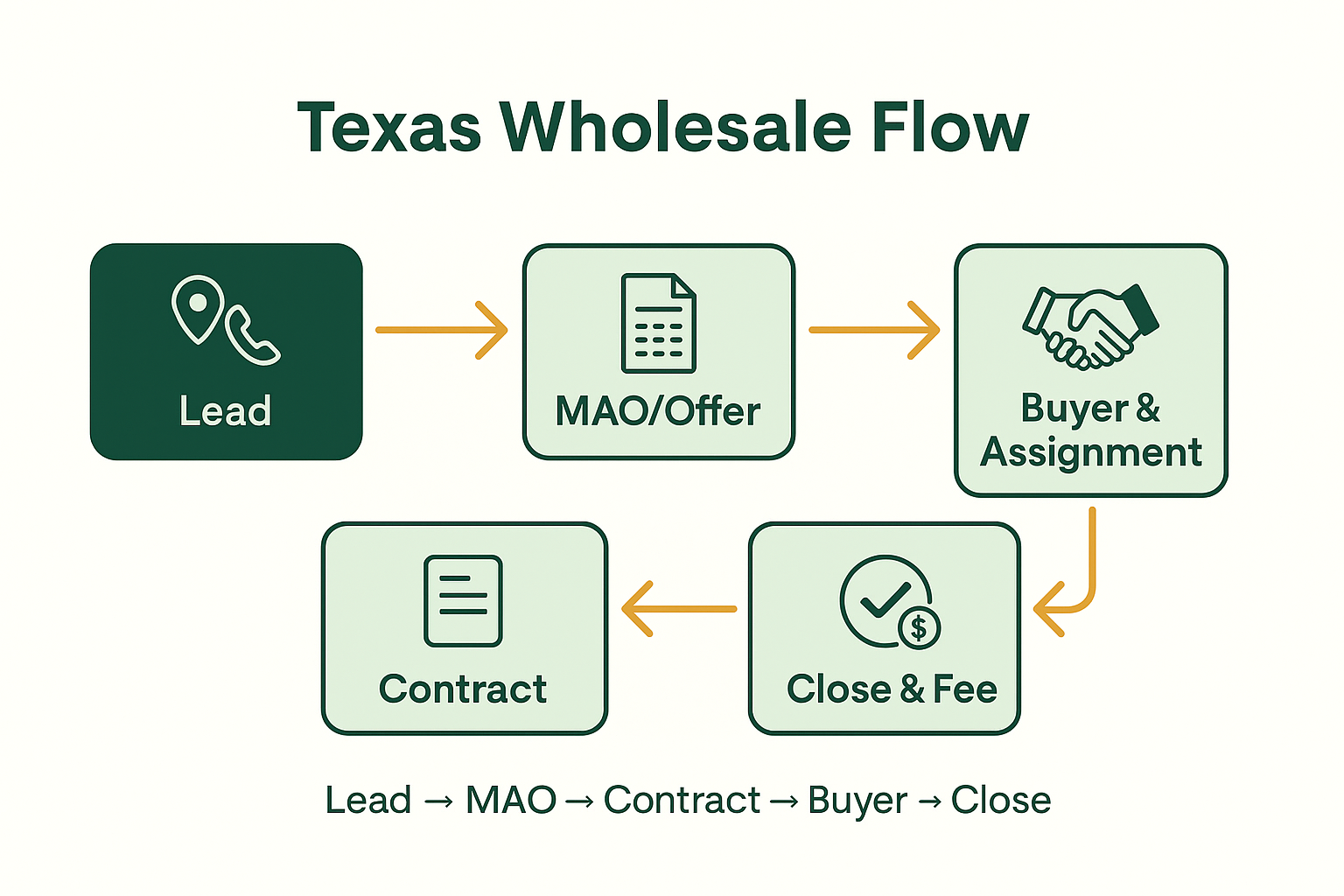

Wholesaling is finding a discounted property, contracting it at that price, and then assigning your contract to a cash buyer for a fee. You’re selling your contractual position—not brokering real estate or pretending to be the owner.

- Your job: source deals, underwrite quickly, lock a purchase agreement, and line up a cash buyer.

- Buyer’s job: fund and close.

- Your money: the assignment fee (e.g., contract at $160,000, assign to buyer at $175,000 → $15,000 fee).

- Two paths: Assignment (most common) or a Double Close (A→B, then B→C same day/48h).

Keep the language clean: market your contractual interest, not the property itself (unless you own it).

Texas-specific disclosures & basics (non-legal advice)

- Transparency: Be clear you may assign your contract. Use a clean assignment clause.

- No agency representation: Unless licensed & operating under broker rules, don’t act like an agent.

- Marketing language: “I’m purchasing your property or assigning my purchase rights to a vetted buyer.”

- Title matters: Work with an investor-friendly title company (assignments & double closes).

- Disclaimer: Not legal/tax advice. Encourage professional review of contracts & taxes.

Pro tip: Before your first deal, call three title companies: “Do you handle assignments and same-day double closes for investors?” If there’s hesitation, move on.

Lead gen: lists that work in Texas today

- Tax-delinquent & code violation (city/county): higher distress probability.

- Pre-foreclosure (NOD/auction lists): timelines are tight; speed wins.

- Vacant/RTS mail: track USPS vacancy flags and your returned mail.

- Tired landlords: out-of-state owners, long ownership, low assessed value, evictions.

- Probate/inherited: be patient and respectful.

- Driving for Dollars (D4D): build 200–300 quality targets per week.

- Networking (agents/wholesalers/meetups/auctions): relationships beat scripts.

Channel stack (2025): Direct mail, phone (DNC compliant), door knocks (safety first), PPC/SEO, local groups/auctions.

Helpful: Tools for Beginners • Top Analysis Platforms (2025) • Flipster Review

Running comps & setting MAO quickly

You’re not an appraiser—you’re defining a buy box.

Rapid ARV in a non-disclosure state

- Use multiple sources: public records + investor platforms + agent help.

- Filters: ±10–15% sq ft; ±10 years build; same subdivision when possible.

- Adjust for big-ticket items (garage, pool, lot size); ignore cosmetic noise.

Rehab quick-math (first pass)

- Lite: $20–$35/sf

- Medium: $35–$60/sf

- Heavy: $60–$90+/sf

MAO baseline

MAO = (ARV × Discount) − Repairs − Fees | Common discount: 65–75% of ARV (market/condition dependent).

Example: ARV $300k → 70% = $210k; − $40k repairs; − $5k fees → MAO $165k. Aim to contract lower ($155–$160k) so the deal moves and your buyer’s spread is intact.

Filling the agreement (line-by-line)

- Parties & property: legal names, your LLC, full address + legal description.

- Price & earnest money: amount, where EMD goes (title), delivery deadline (e.g., 48 hours).

- Option/inspection: 5–10 days shows seriousness; you’re verifying title, access, condition, buyer.

- Closing & possession: target 14–30 days; possession at funding unless agreed otherwise.

- Condition & access: inspection & photo rights; be respectful with showings.

- Title & costs: who chooses title; who pays what; prorations; clean, insurable title.

- Assignment clause: include it. If seller refuses, plan a double close.

- Disclosures: no legal/tax advice; disclose license/relationships if applicable.

- Signatures & dates: e-sign is fine if seller is comfortable.

Keep the base agreement 1–3 pages; attach addenda as needed.

Finding & endearing cash buyers

Where to find them

- Your list (build daily), recent cash deed records, auctions, meetups, FB groups.

- Agents who list flips/rentals; other wholesalers (clear co-wholesale terms).

Qualify (politely, firmly)

- Proof of funds (bank letter or masked statement).

- Buy box (price, zips, bed/bath, finish level).

- Timeline & team (inspection speed, title preference).

- Track record (recent projects, references).

How to “endear” buyers

- Answer the phone; send clean deal packets (photos, ARV comps, rehab scope, access notes).

- Set clear offer deadlines and honor any first-look promises.

Assignment vs double close—when to use which

Assignment (default): simplest, cheapest, fastest. Fee shows on the settlement statement as “Assignment Fee.” Some sellers/buyers/title cos. dislike visible big fees.

Double close (use when…) you want to keep the fee private, the contract is non-assignable, or title requires it. Expect two sets of closing costs; you may need transactional funding unless the title company allows funds to cascade (rare).

Rule of thumb: Small fee (<$7k) → assign. Big fee ($20k+) or sensitive parties → consider double close.

Funding, title, and closing timeline

- Days 0–2: Lead intake & offer — qualify pain/price/timeline; inspect; underwrite; make offer.

- Days 2–3: Signed contract & open title — EMD in on time; seller “what’s next” email.

- Days 3–7: Buyer marketing & access — clean packet; 1–2 hr showing window; collect offers; verify funds.

- Days 7–10: Assignment or prep double close — execute assignment or line up transactional funding; confirm statements.

- Days 10–20: Title curatives — liens/payoffs/heirship/HOA; keep seller informed.

- Days 14–30: Close — walkthrough; sign; fund; fee disbursed by title.

Your next 7 days (no excuses)

- Call 3 title companies; pick one that does assignments & double closes.

- Pull one focused list (tax-delinquent, code violations, or tired landlords).

- Add 100 real sellers to your pipeline (calls, door knocks, or mail).

- Build/clean your buyers list (criteria + proof of funds).

- Set your buy box (ARV range, zips, rehab tiers).

- Prepare your agreement (attorney-reviewed) + assignment form.

- Make 5 written offers (use ranges; get access; iterate).

FAQ

Is wholesaling legal in TX?

Yes—when done properly by selling your contractual interest, not brokering without a license. Use clean contracts and an investor-friendly title company. Consult a Texas real estate attorney for specifics.

Do I need a license?

No. But if you act as an agent (listing/agency advice), different rules apply. Either stay squarely in the wholesaler lane or get licensed and operate under broker supervision.

How much earnest money?

Enough to be credible and meet title expectations—often $100–$1,000 depending on price point and relationship. Confirm with your closer.

How long does it take?

Clean title can close in 14–30 days. Probate, liens, or HOA issues can extend timelines.

Can I do it virtually?

Yes. Use photos/video, e-sign, mobile notary, and a title company that supports remote closings. Vet buyers carefully.

Helpful internal resources:

Ready to make this real?

Grab the no-nonsense Texas Wholesaling Checklist—contracts, scripts, and a first-deal timeline.

#TexasRealEstate, #Wholesaling, #DFW, #Dallas, #FortWorth, #WeBuyHouses, #OffMarketDeals, #CashBuyers, #SubjectTo, #Novation, #Assignment, #DoubleClose, #ARV, #MAO, #Comps, #RehabCosts, #MotivatedSellers, #TitleCompany, #RealEstateInvesting, #InvestorTips

Leave a Reply